An increase in bankruptcies and insolvencies is predicted within the next year: Canadian Association of Insolvency and Restructuring Professionals

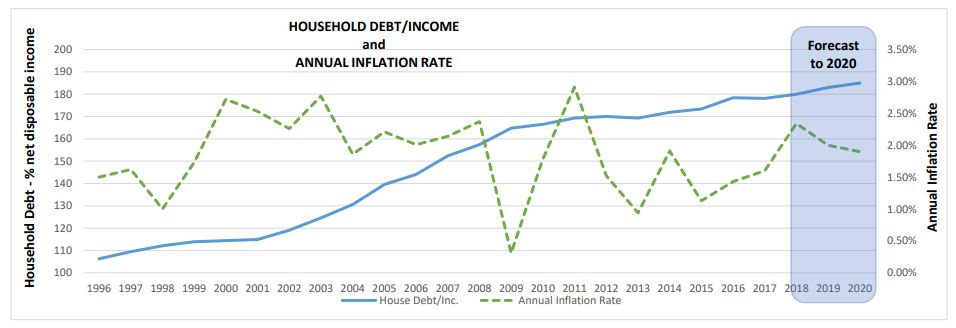

TORONTO – (November 16, 2018) – Low interest rates and access to credit have allowed some borrowers to keep up with debt repayments that otherwise would have been unmanageable. However, rising interest rates, coupled with near record high consumer debt levels, are expected to increase the number of Canadian consumers who will be forced into insolvency, according to the Canadian Association of Insolvency and Restructuring Professionals (CAIRP).

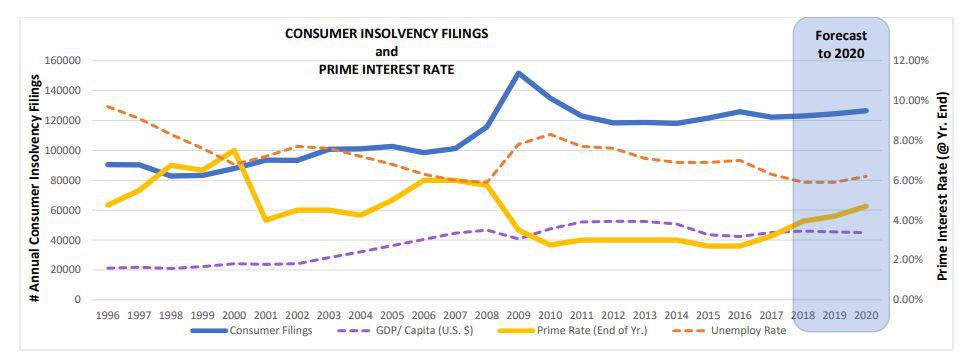

Historically there has been about a two-year lag between the time interest rates begin to rise and when consumer insolvency filings start to increase. Consider that rising interest rates during the periods of 1996 to 2000 helped fuel a 22% increase in the number of annual consumer insolvency filings from 1998 to 2003. Interest rates increases from 2004 to 2006 fueled a 54% jump in the number of annual consumer insolvency filings between 2006 and 2009.

With relatively stable interest rates from 2010 through to 2016, annual consumer insolvency rates in Canada have been fairly consistent since 2012. However, with interest rates trending upward since 2017, CAIRP expects to see a corresponding trend for insolvency filings heading into 2019.

“For more than a year, the issue of high consumer debt and rising interest rates have been a growing concern but they haven’t been reflected yet in the number of consumer insolvency filings. That’s due to the insolvency time lag that occurs between the point trouble begins and the point at which overextended individuals are forced to begin the debt resolution process”, says Chantal Gingras Chair of CAIRP, the country’s national association of insolvency and restructuring professionals which represents nearly 1,500 trustees and associates across the country.

Compounding the concern is that rising interest rates will also cool consumer spending, Canadian GDP and business growth. These conditions could lead to an uptick in the unemployment rate, further accelerating the rate of consumer insolvency filings.

“While none of these factors cause bankruptcies on their own, together they are the perfect storm,” says Gingras.

Source: Statistics Canada; OECD; OSB

Source: Statistics Canada; OECD; OSB

Supporting CAIRP’s prediction, a recent member survey found that over seventy percent of insolvency professionals believe consumer insolvency filings will rise over the next five years. Almost all (97%) believe they will increase or stay the same over the next year.

Ninety-five per cent of CAIRP members surveyed believe Canadians possess unhealthy levels of debt. Respondents said that ease of credit, a lack of financial literacy, and rising interest rates are the biggest contributors.

The primary causes of personal bankruptcy are a high level of consumer debt coupled with an unexpected life event, such as the loss of a job, health issues, a major expense, divorce, or the death of a spouse. For Canadians who are already severely indebted, the increase in interest payments may also be a catalyst.

Financial education and consumer protection on loans are other key issues related to Canada’s consumer debt problems. Over 80 per cent of the insolvency professionals surveyed said that consumer filings would decline if Canadians were more financially literate. Six in ten said that greater consumer protection would also reduce the number of consumer insolvency filings.

“A person who is unable to meet their financial commitments does not automatically go bankrupt; in an environment where credit is easily accessible, they simply borrow more. Those who don’t have strong personal finance skills are more easily lured into increasing lines of credit, taking on high-cost payday loans or credit cards. Credit can be a benefit to consumers when used wisely, but for those without financial savvy, it can quickly become an inescapable cycle of debt,” she says.

A consumer bankruptcy or proposal can be a powerful tool for Canadians who would otherwise be trapped, but Gingras says the stigma of bankruptcy prevents many from seeking help.

“Unfortunately, only a small portion of people who have difficulty keeping up with bills and payments seek professional help. Those who do, too often wait until they are in a dire situation. It’s important to recognize the scale of the problem early and take action right away,” she says.

For Canadians who find themselves unable to meet their repayment requirements, there are a variety of options to consider: striking a deal with creditors through an informal debt settlement; consolidating all debts into one monthly repayment; making a debt repayment plan through a consumer proposal; or declaring bankruptcy. Determining which option is most suitable depends on an individual’s circumstances and debt levels.

Licensed Insolvency Trustees are the only professionals licensed by the federal government to deal with debt restructuring. Their customized approach helps individuals better understand all their options.

ABOUT CAIRP

The Canadian Association of Insolvency and Restructuring Professionals (CAIRP) is the national professional organization representing more than 980 members working in the insolvency system, as well as over 500 articling, life and corporate associates. Almost ninety percent of Licensed Insolvency Trustees, licensed under Canada’s Bankruptcy and Insolvency Act are members of CAIRP.

CAIRP conducted the member opinion survey by email in October 2018. Almost a third of the 1100 designated and licensed insolvency professionals from across Canada took part.

(296 votes, average: 4.58 out of 5)

(296 votes, average: 4.58 out of 5)

Recent Comments